Personal Injury Protection Claims: A Guide to Navigating the Legal Maze

**Introduction**

If you’ve been involved in a car accident, you’re probably feeling overwhelmed and uncertain about your next steps. One important aspect of navigating this difficult time is understanding personal injury protection claims. This type of insurance coverage can provide essential financial support for medical expenses and other losses stemming from the accident. In this comprehensive guide, we’ll delve into the details of personal injury protection claims, empowering you with the knowledge and confidence to make informed decisions.

What is a Personal Injury Protection Claim?

Personal injury protection (PIP) is a type of insurance coverage that helps cover medical expenses, lost wages, and other losses incurred as a result of a car accident. It’s designed to provide immediate financial relief, regardless of who is at fault for the accident. PIP policies typically have limits on the amount of coverage available, and the benefits vary depending on the insurance provider and the state in which you live.

PIP is particularly crucial for individuals who lack health insurance or have high deductibles. It can bridge the gap between immediate medical expenses and long-term recovery costs. Additionally, PIP coverage can cover lost wages, transportation expenses, and other miscellaneous costs associated with the accident.

In some states, PIP coverage is mandatory, while in others, it’s optional. It’s important to check your insurance policy or contact your insurance provider to determine if you have PIP coverage and what the limits are. Understanding your PIP benefits can empower you to make informed decisions about your medical care and financial recovery.

Filing a Personal Injury Protection Claim

If you’ve been injured in a car accident, it’s essential to promptly file a personal injury protection claim. The sooner you file your claim, the sooner you can start receiving benefits. Here are the steps involved:

1. **Notify your insurance company:** Contact your insurance provider immediately after the accident to report the incident and initiate the claims process. Provide them with details such as the date, time, location, and other parties involved.

2. **Gather evidence:** Collect all relevant documentation, including the police report, medical records, and any other evidence that supports your claim. This will help substantiate your injuries and expenses.

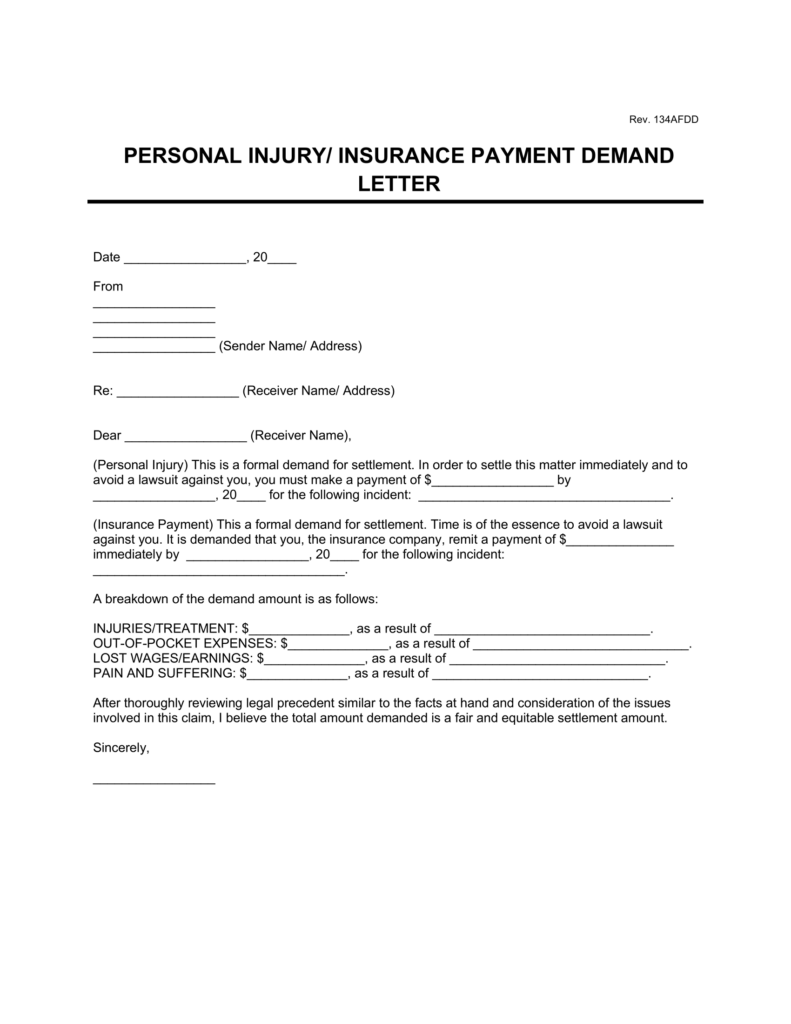

3. **Submit your claim:** Complete the necessary paperwork and submit it to your insurance company. Be comprehensive and accurate in providing details about your injuries, medical expenses, and other losses.

4. **Cooperate with the insurance company:** The insurance company will likely assign an adjuster to handle your claim. Cooperate with their requests for information and medical exams to facilitate the claims process.

5. **Negotiate a settlement:** Once the insurance company has evaluated your claim, they will likely offer a settlement. Review the offer carefully and negotiate if necessary to ensure fair compensation for your losses.

Personal Injury Protection Claims: What You Need to Know

After a car accident, the last thing you want to deal with is a pile of paperwork and insurance jargon. But if you’ve been injured, filing a personal injury protection (PIP) claim can help you get the compensation you deserve. Here’s everything you need to know about PIP claims, including when to file, what’s covered, and how to maximize your recovery.

When to File a Personal Injury Protection Claim

The key to a successful PIP claim is filing promptly. Most states have a statute of limitations for filing insurance claims, so don’t delay. Contact your insurance company as soon as possible after the accident to start the process. Even if you don’t know the extent of your injuries yet, it’s important to file a claim to preserve your rights.

What’s Covered Under a Personal Injury Protection Claim

PIP coverage varies from state to state, but it typically includes medical expenses, lost wages, and pain and suffering. Medical expenses can include everything from hospital bills to doctor’s visits to physical therapy. Lost wages can be reimbursed for the time you miss work due to your injuries. Pain and suffering is a more subjective category, but it can include compensation for emotional distress, scarring, and disfigurement.

The amount of coverage you’re entitled to depends on your policy limits. Most states have minimum PIP coverage requirements, but you can purchase additional coverage if you want to be sure you’re fully protected. Your insurance policy will outline the specific coverage you have.

How to Maximize Your Recovery

Getting the most out of your PIP claim is all about documenting your injuries and damages. Keep a detailed record of your medical expenses, including bills, receipts, and doctor’s notes. Also, keep track of your lost wages and any other expenses you incur as a result of your injuries. The more documentation you have, the stronger your claim will be.

It’s also important to be prepared to negotiate with your insurance company. They may try to offer you a settlement that’s less than what you deserve. Don’t be afraid to stand up for yourself and negotiate for a fair settlement. If you’re not comfortable negotiating on your own, you can hire an attorney to help you.

Personal Injury Protection Claim: A Guide for Victims

In the event of an unfortunate accident, understanding your rights and filing a personal injury protection (PIP) claim can be crucial to safeguard your well-being. A PIP claim ensures that you receive compensation for medical expenses, lost income, and other damages resulting from the accident. But what should you include in this claim? This article provides a detailed guide to help you navigate the process and ensure your claim is both comprehensive and effective.

What to Include in a Personal Injury Protection Claim

A well-structured PIP claim should paint a clear picture of the accident, your injuries, and the expenses you have incurred. The following essential elements should be included:

- Accident Details: Provide a thorough account of the accident, including the date, time, location, and a description of how it occurred. Include relevant details such as weather conditions, road conditions, and the contact information of any witnesses.

- Injury Details: Describe your injuries in detail, including the type of injury, location on your body, severity, and any ongoing pain or symptoms. Medical documentation, such as doctor’s reports and hospital records, is crucial to support your claim.

- Medical Expenses: Itemize all medical expenses related to your injuries, including doctor’s visits, hospital stays, physical therapy, and medication. Attach copies of receipts or invoices to prove your expenses.

- Lost Income: If the accident has impacted your ability to work, provide documentation of your income loss, such as pay stubs or tax returns. Lost wages, bonuses, and benefits should be included in your claim.

- Other Damages: Beyond medical expenses and lost income, you may also claim for other damages such as pain and suffering, emotional distress, and property damage. Describe the extent of these damages and provide evidence to support your claim.

Supporting Your Claim

To strengthen your claim, gather as much evidence as possible to support your assertions. This may include:

- Medical records and doctor’s notes

- Photos of the accident scene and your injuries

- Eyewitness statements

- Police reports

- Documentation of lost income

- Receipts and invoices for medical expenses

Filing Your Claim

Once you have gathered the necessary information, it’s essential to file your PIP claim promptly. The time limit for filing varies by jurisdiction, so checking the relevant laws is crucial. Most insurance companies have specific procedures for submitting PIP claims. Ensure you follow their instructions and submit all required documentation to avoid delays or denials.

By understanding the elements of a comprehensive PIP claim and supporting your assertions with evidence, you can increase your chances of obtaining fair compensation for the damages you have suffered. Navigating the personal injury protection claim process can be challenging, but adhering to these guidelines will help you safeguard your rights and ensure you receive the support you need to recover from your injuries.

After a car accident, filing a personal injury protection claim can be a daunting task. It’s like being lost in a maze, unsure which way to turn. But don’t worry, I’m here to serve as your trusty guide, helping you navigate the complexities of the process and find the path to recovery.

How Long Does it Take to Process a Personal Injury Protection Claim?

Just like no two snowflakes are alike, every personal injury protection claim is unique. The time it takes to process your claim depends on several factors, including the insurance company involved and the intricacies of your case. It can be a speedy journey, completed within a few weeks, or it can stretch into a marathon, taking months or even years.

What Can I Do to Speed Up the Process?

To accelerate the processing of your claim, consider these tips: Gather evidence, the more, the merrier. This includes medical records, police reports, and witness statements. The more ammo you have, the stronger your case will be. Stay in touch with your insurance company. Don’t play hide-and-seek. Keep your insurance company informed of your progress and provide any additional information they request promptly.

What Should I Do if My Claim is Denied?

If your claim is denied, don’t throw in the towel just yet. There are still options available to you. You can file an appeal, seeking a second opinion. Or you can consider legal action, hiring an attorney to fight for your rights.

What if I Don’t Have Insurance?

If you’re driving without insurance and involved in an accident, don’t panic. While it’s not an ideal situation, there are still steps you can take to protect yourself. Contact the other driver’s insurance company and file a claim. Explore your options for obtaining legal representation. Don’t go it alone. An experienced attorney can guide you through the process and help you secure the compensation you deserve.

Conclusion

Navigating a personal injury protection claim can be a bumpy road, but with patience and persistence, you can reach the finish line. Remember, knowledge is power, and the information provided in this article should empower you to make informed decisions throughout the process. If you encounter any roadblocks along the way, don’t hesitate to seek professional guidance. An attorney can help you navigate the complexities of the legal system and ensure your rights are protected.

Personal Injury Protection Claims: Know Your Rights

You pay your premiums every month, so you expect your insurance company to be there for you when you need them. But what happens when you file a personal injury protection (PIP) claim and it’s denied? It can be a frustrating and confusing experience, but it’s important to know your rights and what steps you can take to get the benefits you deserve.

Understanding PIP Coverage

PIP coverage is designed to cover medical expenses, lost wages, and other costs associated with injuries sustained in a car accident. It’s a “no-fault” coverage, meaning you can file a claim regardless of who caused the accident. However, there are certain requirements that must be met in order to qualify for benefits, such as:

- The accident must have occurred in the state where you have PIP coverage.

- You must have been in the car or on a motorcycle at the time of the accident.

- You must have sustained injuries that require medical attention.

Filing a PIP Claim

If you’ve been injured in a car accident, it’s important to file a PIP claim as soon as possible. You can do this by contacting your insurance company and providing them with the details of the accident. Your insurance company will then review your claim and determine whether or not you qualify for benefits.

What to Do if Your PIP Claim is Denied

If your PIP claim is denied, you have the right to appeal the decision. You can do this by submitting a written appeal to your insurance company within 30 days of receiving the denial letter. In your appeal, you should explain why you believe your claim should be approved. You can also provide any additional documentation that supports your claim, such as medical records or witness statements.

If your appeal is denied, you may have the option to file a lawsuit against your insurance company. This is a more complicated process, but it may be necessary if you believe that your insurance company has wrongfully denied your claim.

Getting the Benefits You Deserve

Filing a PIP claim can be a complex process, but it’s important to know your rights and what steps you can take to get the benefits you deserve. If your claim is denied, don’t give up. You have the right to appeal the decision and, if necessary, file a lawsuit. With persistence and determination, you can get the benefits you need to recover from your injuries and move on with your life.